These days, people seem to be more interested in the glamorous lifestyles of celebrities and entertainers than ever before. Ask any college student who Beyonce is and they can probably tell you more about her personal life than they can about who their state representative is, or who some of the top corporations are who influence the purchasing decisions that these celebrities market influencing the spending trends within their country. This is becoming an international phenomenon. Entertainment industry professionals, like Beyonce generate a significant portion of their wealth, not just by possessing a specific talent or skill, but also by being able to commercially brand themselves in order to help corporations market and sell their products. By performing and being able to expanding their influence into the international market base, celebrities are able to define new fashion and spending trends thus controlling consumption patterns even in foreign markets. This contributes to the popular and overwhelming growth of globalization which makes it possible from this Houston based singer to transform into an international superstar.

But is that necessarily a good thing?

Are You Buying into the "Global" phenomenon that is keeping the rest of the world poor?

Most people aren’t really educated to realize is how globalization works. And if you ask most people they wouldn't even really be able to tell you what globalization really means.

Pronunciation: \ˌglō-bə-lə-ˈzā-shən\

: the act or process of globalizing : the state of being globalized; especially : the development of an increasingly integrated global economy marked especially by free trade, free flow of capital, and the tapping of cheaper foreign labor markets

Nike is an example of a powerful multi-national corporation under criticism for its globalization model which includes outsourcing jobs overseas, using toxic chemicals in its products and numerous other alleged human rights violations. Arguably, Nike also does a fair share of humanitarian work and their plants boost economic development in areas that otherwise would not have access to jobs or be able to provide for economic necessities [ie food, clean water, hospitals, scholarships, etc].

Investorwords. com, an internet glossary on the web defines globalization as the following:

Name for the process of increasing the connectivity and interdependence of the world's markets and businesses. This process has speeded up dramatically in the last two decades as technological advances make it easier for people to travel, communicate, and do business internationally. Two major recent driving forces are advances in telecommunications infrastructure and the rise of the internet. In general, as economies become more connected to other economies, they have increased opportunity but also increased competition.

Thus, as globalization becomes a more and more common feature of world economics, powerful pro-globalization and anti-globalization lobbies have arisen. The pro-globalization lobby argues that globalization brings about much increased opportunities for almost everyone, and increased competition is a good thing since it makes agents of production more efficient. The two most prominent pro-globalization organizations are the World Trade Organization and the World Economic Forum. The World Trade Organization is a pan-governmental entity (which currently has 144 members) that was set up to formulate a set of rules to govern global trade and capital flows through the process of member consensus, and to supervise their member countries to ensure that the rules are being followed. The World Economic Forum, a private foundation, does not have decision-making power but enjoys a great deal of importance since it has been effective as a powerful networking forum for many of the world's business, government and not-profit leaders.

The anti-globalization group argues that certain groups of people who are deprived in terms of resources are not currently capable of functioning within the increased competitive pressure that will be brought about by allowing their economies to be more connected to the rest of the world. Important anti-globalization organizations include environmental groups like Friends of the Earth and Greenpeace; international aid organizations like Oxfam; third world government organizations like the G77; business organizations and trade unions whose competitiveness is threatened by globalization like the U.S. textiles and European farm lobby, as well as the Australian and U.S. trade union movements (Investorwords.com).

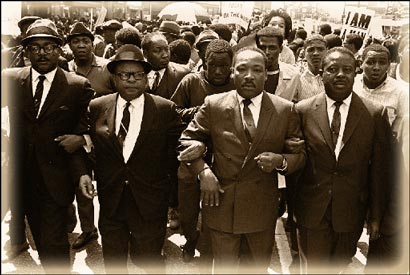

Most people have seen clips of Martin Luther King Jr.'s "I've been to the Mountaintop" speech in Memphis where he died, but relatively few know that he was there as part of a sustained campaign to support an AFSCME strike of santitation workers demanding a union (Nathan). Dr. Martin Luther King Jr. lost his life in Memphis, Tenn., where he had gone to support striking sanitation workers in their fight to get the city to recognize their union, AFSCME Local 1733 (AFSCME).

Any disruption to the infrastructure of this system, whether it is a decrease of materials and supplies, regulation limiting the amount of raw materials that can be removed from foreign entities or even a simple labor strike would disrupt the system. Consequently, this would also limit the flow of money allocated through tax dollars to serve public institutions [schools, hospitals, education, community programming, Military Spending]. To minimize the risk of such disruption, government officials and economic analysts use spending incentives [such as the stimulus packages] in order to keep money circulating within the system. Those who spend more are more likely to see the benefits of the tax spending, but because those who are able to make larger purchases [such as homes, stocks, business investments] are often more educated and organized to influence policy decisions, many of the advantages toward participating in this system of economics are allocated toward those who contribute the most. The rest is then trickled down in the form of wages and invoices for supplies so that they can be taxed in order to generate more revenue for the state and federal economies.

Unfortunately our reliance upon the external inputs [ie, materials, workers, consumers] that are needed to keep this system circulating is facing perhaps the biggest crisis the world has ever seen. And the more inputs that are disrupted, through factors such as job loss; demand fluctuations, change in regulations or inaccessibility of the materials needed to maintain the supply; the more difficult it becomes to remedy problems such as poverty, joblessness and the economic collapses that will inevitably occur by having a system so highly dependent upon outside resources.

But some who might be seeing this may be thinking, “Yeah, that’s pretty messed up. But that’s just the way that the world works. No one person is ever going to be able to change the world. Hey, at least it puts food on the table. “

But does it really? Linear Monetary systems are designed to put control of the world’s resources into the hands of those who can afford higher levels of education or can contribute the most through monetary inputs. The banking and lending industry is the primary example of how the financial sector was designed to reward those who can afford to keep money flowing through the monetary system, thus tilting the economic scale – and not in the menial worker’s favor.

This flow chart shows a brief overview of how the design of the current agricultural system impacts the pricing of food as it travels throughout various economic levels of the food chain.The Bottom Line

The food chain is a term to describe the various transformations a food commodity goes through from the point at which seed is planted by the farmer to the last stage when it is acquired by the final consumer. This can be a very simple chain, where grain is grown by the farmer, threshed and milled within the farm household and then cooked and eaten by the family. It can also be very complicated, as when wheat is imported from a major grain exporter such as the USA, milled into flour domestically, sold to a commercial bakery company and then distributed through a supermarket chain. In all cases, the nature of the food chain, the number of stages of processing and transportation through which the commodity passes, the level of efficiency and technical sophistication and capital intensity of the processing, and the degree of competition at different stages of the food chain, all are important in determining the availability of the commodity, in physical terms of amount and geographical distribution, and in economic terms of the price level (FAO). To read more click here.

The current economic system has its interests staked upon our ability to circulate money rather than focusing upon meeting basic needs. For those without access to monetary resources, this means that as less money flows into the monetary system, as people save and conserve their expenditures, that there is less money to be taxed thus lowering the amount of money the government can allocate for funding. Such a disruption inevitably would also limit the amount of funding allocated toward public services, which the impoverished and uninsured rely upon. This system, which has the capability to impact the economic welfare of anyone integrated within it, would be vulnerable to any failure or collapse that could disrupt this system leaving the needs of those that do not have the monetary capital or resources to negotiate for those inputs left out.

But is taxation really the solution?

Tax Burden of Top 1% Now Exceeds That of Bottom 95%July 29, 2009

While it seems fitting to some that the wealthy show more of an ability to pay, it does not sidestep the issue that even with the nation’s top earners footing a significant portion of the bills that we are still sinking into an economic abyss that won’t seem to be remedied with the application of more taxes.Newly released data from the IRS clearly debunks the conventional Beltway rhetoric that the "rich" are not paying their fair share of taxes.

Indeed, the IRS data shows that in 2007—the most recent data available—the top 1 percent of taxpayers paid 40.4 percent of the total income taxes collected by the federal government. This is the highest percentage in modern history. By contrast, the top 1 percent paid 24.8 percent of the income tax burden in 1987, the year following the 1986 tax reform act.

Remarkably, the share of the tax burden borne by the top 1 percent now exceeds the share paid by the bottom 95 percent of taxpayers combined. In 2007, the bottom 95 percent paid 39.4 percent of the income tax burden. This is down from the 58 percent of the total income tax burden they paid twenty years ago.

To put this in perspective, the top 1 percent is comprised of just 1.4 million taxpayers and they pay a larger share of the income tax burden now than the bottom 134 million taxpayers combined.

Some in Washington say the tax system is still not progressive enough. However, the recent IRS data bolsters the findings of an OECD study released last year showing that the U.S.—not France or Sweden—has the most progressive income tax system among OECD nations. We rely more heavily on the top 10 percent of taxpayers than does any nation and our poor people have the lowest tax burden of those in any nation.

We are definitely overdue for some honesty in the debate over the progressivity of the nation's tax burden before lawmakers enact any new taxes to pay for expanded health care.

[Click chart to enlarge.]

For more on this topic, a new Tax Foundation Fiscal Fact includes eight charts of just-released IRS data, and an accompanying dataset breaks the numbers down even further. Read the new Tax Foundation Fiscal Fact or view the data (an Excel sheet is available for download at the bottom of the data page).

#1 Angelina JolieJolie's fame, evidenced by magazine covers and TV, radio, newspaper and Web stories, outweighed Winfrey's, giving her the edge as "the most powerful celebrity in the world" based on Forbes' formula, Forbes Senior Editor Matthew Miller said (Duke).#2 Oprah WinfreyWinfrey, who was at the top for two years straight, grossed $275 million last year, compared with Jolie's $27 million, Miller said. "We try and measure a celebrity's power, and we look at two metrics to do that," Miller said. "We look at money, and we look at fame (Duke)."#3 Madonna

A world tour, which helped Madonna pull in $110 million, and a bumper crop of tabloid gossip pushed the Material Girl into the third spot, up from her 21st ranking on last year's list (Duke).#4 Beyoncé KnowlesBeyonce Knowles held steady in fourth, same as last year, with $87 million in income from her multiplatform empire, Miller said. Forbes leveraged the singer-actresses fame by placing her on this week's cover(Duke).#5 Tiger WoodsA bad knee kept Tiger Woods off the PGA tour over the past year and lowered him to the fifth spot on the Forbes list. The golfer, still the highest-paid athlete in the world, was second last year (Duke).

But just to put things into a little bit of perspective, let’s look at the reason why 80% of the world’s wealth is controlled by 1% of the population. Titans of industry such as Henry Ford, Bill Gates, Oprah Winfrey have learned to amass their fortunes not by innovating new products, but more significantly by dictating trends and patterns of consumer behavior that keeps money circulating within the system. This can be seen in the

1. Barack Obama

Issues >> Economy

Source: The White House

President Obama’s central focus is on stimulating economic recovery and helping America emerge a stronger and more prosperous nation. The current economic crisis is the result of many years of irresponsibility, both in government and in the private sector. As we look toward the future, we must confront the many dimensions of this crisis while laying the foundation for a new era of responsibility and transparency.

Creating Jobs

President Obama’s first priority in confronting the economic crisis is to put Americans back to work. The American Recovery and Reinvestment Plan signed by the President will spur job creation while making long-term investments in health care, education, energy, and infrastructure. Among other objectives, the recovery plan will increase production of alternative energy, modernize and weatherize buildings and homes, expand broadband technology across the country, and computerize the health care system. The recovery plan will save or create about 3.5 million jobs while investing in priorities that create sustainable economic growth for the future.

2. Hu Jintao

Innovation tops Hu Jintao's economic agenda

By: Report on The Scientific Outlook on Development

Source: 17th CPC National Congress

2007-10-15 10:14:55

Special Report: 17th CPC National Congress

BEIJING, Oct. 15 (Xinhua) -- Hu Jintao underscored the task of enhancing China's capacity of independent innovation and making it an innovative country in a political report to the 17th National Congress of the Communist Party of China (CPC) Monday morning.

"This (innovation) is the core of our national development strategy and a crucial link in enhancing the overall national strength," said Hu while delivering the report on behalf of the 16th CPC Central Committee.

Hu pledged to increase spending on independent innovation and make breakthroughs in key technologies vital to economic and social development, saying China will speed up forming a national innovation system and support basic research, research in frontier technology and technological research for public welfare.

He said the country will step up efforts to establish a market-oriented system for technological innovation, in which enterprises play the leading role, and encourage formation of internationally competitive conglomerates.

3. Vladimir Putin

Putin wants new economic "architecture"

By Andrew E. Kramer

Published: Sunday, June 10, 2007

Source: The New York Times

ST. PETERSBURG — President Vladimir Putin sought to reassure investors and foreign leaders that Russia remained committed to free trade and investment for businesses that work here, in spite of a chill in political relations with the West.

But Putin said Russia would integrate with the world economy on its own terms - and possibly not by embracing the current rules of the global economic order.

Speaking at a business forum here Sunday, Putin called for a new world economic framework based on regional alliances rather than global institutions like the International Monetary Fund.

The new system, he said, would reflect the rising power of emerging market economies like Russia, China, India and Brazil, and the decline of the old heavyweights of the United States, Japan and many European countries.

4. Ben S. Bernanke

Person of the Year 2009

By Michael Grunwald

Source: Time Magazine

Bernanke is the 56-year-old chairman of the Federal Reserve, the central bank of the U.S., the most important and least understood force shaping the American — and global — economy. Those green bills featuring dead Presidents are labeled "Federal Reserve Note" for a reason: the Fed controls the money supply. It is an independent government agency that conducts monetary policy, which means it sets short-term interest rates — which means it has immense influence over inflation, unemployment, the strength of the dollar and the strength of your wallet. And ever since global credit markets began imploding, its mild-mannered chairman has dramatically expanded those powers and reinvented the Fed.

Professor Bernanke of Princeton was a leading scholar of the Great Depression. He knew how the passive Fed of the 1930s helped create the calamity — through its stubborn refusal to expand the money supply and its tragic lack of imagination and experimentation. Chairman Bernanke of Washington was determined not to be the Fed chairman who presided over Depression 2.0. So when turbulence in U.S. housing markets metastasized into the worst global financial crisis in more than 75 years, he conjured up trillions of new dollars and blasted them into the economy; engineered massive public rescues of failing private companies; ratcheted down interest rates to zero; lent to mutual funds, hedge funds, foreign banks, investment banks, manufacturers, insurers and other borrowers who had never dreamed of receiving Fed cash; jump-started stalled credit markets in everything from car loans to corporate paper; revolutionized housing finance with a breathtaking shopping spree for mortgage bonds; blew up the Fed's balance sheet to three times its previous size; and generally transformed the staid arena of central banking into a stage for desperate improvisation. He didn't just reshape U.S. monetary policy; he led an effort to save the world economy.

To Read more click here

5. Sergey Brin and Larry Page

DECEMBER 27, 2004

THE GREAT INNOVATORS

Larry Page And Sergey Brin: Information At Warp Speed

Source: Business Week

“…Although the Google founders were sure their technology was a quantum leap forward, they had no clue how to turn it into a business. Initially they scorned the notion of accepting ads. But after a competitor began selling ads around search results for sizable profits, Google followed suit. Its superior technology brought in hordes of users, igniting ad sales. Today, Google is a $2 billion advertising juggernaut, with marketers clamoring to nestle their ads alongside its search results.

With success has come plenty of challenges. Google's stock has doubled, to $170, since its August initial public offering. That price reflects tall expectations, particularly with Yahoo and Microsoft Corp. (MSFT ) charging ahead in search. Regardless of how Google fares, however, its founders' innovation is clear. We can find out more, and find it more easily, than ever before.”

To read more click here

Out of Forbes Top 5 Most Powerful people in the world [technically top 6], only 1 out of those 5 were considered as such for a product that they innovated – and even they had to revert to the promotion of advertisements in order to amass their wealth.

The Forbes List of Top 5 Billionaires

1. William Gates III – co-founder and CEO of Microsoft Corporation

2. Warren Buffett – Chairman of the Investment Firm Berkshire Hathaway

3. Carlos Slim Helu & Family – Media & Telecom Tycoon

4. Ingvar Kamprad & Family – Founder of Ikea

5. Karl Albrecht- German supermarket tycoon [Aldi]

Those who make it to the top of Forbes lists are often featured because they are investors who not only gained monopolies producing products in their own fields, but expanded their knowledge of business to form investment opportunities in multi-national conglomerates influencing share holder investment behavior in many of the world’s most profitable stock portfolios.

To take advantage of this uneven hand of the free market, the power to influence consumer behavior has been capitalized upon by industry tycoons or strategically manipulated by CEOs of corporations in order to influence investment holdings in the world’s energy sectors, telecommunications, business models, education, utilities and even pharmaceuticals that are made accessible for public safety, security and public health. By providing access to wealth through investment opportunities in corporations that offer corporate shares, corporations [which legally act as individual taxable entities that generate their own revenue] are able to pump large amounts of money into the economy and disperse wages, private funding and other forms of circulation through the monetary system.

The only catch is that consumers must continue to invest in these corporations and buy the products that are sold to increase the amount of money provided to the government through taxable wealth. The banking system was established with the help of the treasury and the Federal Reserve to monitor and redistribute some of the nation’s wealth. By keeping money circulating throughout the system the lending industry is able to expand access to its taxable market shares. By offering loans and securing funds to lenders and to organizations through insurance, investors can generate wealth and fund other public resources, while providing jobs and therefore taxable wages – which means more consumers – to increase the profits of the corporations they invest in as well as contribute taxes to public services and increase national wealth. This system it also benefits lenders that provide corporations with funding incentives and grants to companies for filing for an IPO [initial public offering] in order to increase the capital for these corporations that could be used in the expansion of jobs and provide economic development in under-served areas -- as they circulate and redistribute the nation’s wealth.

Unfortunately, the way that the system is designed, as we’ve seen recently, any disruption that reduces the ability of the money to circulate within the system reduces the amount of money that goes into public services; money that could be used to provide education and other basic needs like health care. The role of the federal reserve, and Bernanke did a pretty decent job of keeping up with this -- is to identify and redistribute money in times of economic crisis in order to increase consumer spending through stimulus packages and bailouts to industries that supply the most workers [ie GM] or other contributors that influence consumer spending and the nation’s wealth [ie Wall Street]. This occurs so that this pattern can continue to generate wealth that continues to trickle down and pay for essential public services.

Taxation has always been the glue that has held together the monetary loop. But the monetary system has become far too dependent upon the linear system of consumption, and the more complicated these integrated networks become, the more likely that a crisis becomes inevitable. Once the problem that is disrupting the system derives from an essential source, such as the scarcity of supply [from over-extraction] we are left with fewer raw materials. This means that not only do we have less jobs to process these materials, but we also have less money circulating within the system. This results in less money to help those who really need it. And yet currently we are over processing and over consuming more resources than are made available without triggering such an economic collapse. With the growing demand of these resources and increasingly abundant population [currently over 6.7 billion], we have continuously exhausted the limitations of the earth’s natural resources in a manner that is more focused upon circulating revenue than at preventing the factors that hinder the ability to meet basic human needs, to our own unfortunate demise.

for future generations.

As long celebrities and entertainers continue to promote consumerism as a measure of success, they will continue to enable the black middle and working class to spend their money upon useless items instead of making significant investments in the education and their health. This trend of ghetto fabness [purchasing clothes, jewelry, car accessories, cellphones, etc.] is unfortunately the primary instrument that encourages the impoverished and economically unsaavy to continue to rely upon an obsolete system. This makes them vulnerable to mental and economic enslavement and continues to put those who can least afford it last -- and at the mercy of the whims of charities and philanthropists. It would be more socially responsible for not just celebrities, but for educated African Americans to remember -- that People who do not invest in their own futures will never be able to have their needs met, because the system simply isn't designed to help support and sustain them in the long term.

Rather than encourage spending trends that keep people in debt, it is up to our leaders, activists and educators to take a more interactive approach to eradicating the roots of poverty by planting seeds [yes actual seeds] of progress and teaching the under served more sustainable methods of ensuring that their needs are met. With the advances of perma culture, clean alternative energy [NOT nuclear or bio diesel], and relocalization efforts, communities can begin to make the most significant steps to ensuring their needs are met by instituting these infrastructural and agricultural reforms.

Better yet, the advantages of relieving the economic burden that the working poor often pose to the monetary system could free up revenue to improve other areas besides public services. Those who could afford taxes could then focus their spending upon other services such as technological innovation in security, communications and other scientific research -- with money that is currently being used for public aid for food, housing and healthcare that could be provided cheaper and more effectively to meet the needs of the community by educating and training those with lower incomes to produce these things themselves. Jobs would be created. Literacy would be improved. The impoverished could improve their own capacity for resilience and locally regulate themselves if the inputs were produced locally using sustainable means. Instead of being raised by televisions and video games, America's youth could learn skills that would teach them how to become better contributor's to the monetary system, not through blind consumerism, but by learning how to identify and create items for the market that people in their communities or around the world would really need.

This would also allow those who are looking for opportunities for investment to contribute to the monetary system by funding the training of those who show merit in these areas, rather than just based upon test scores as a measure of aptitude, widening opportunities for applicable and engaged learning and the re-expansion of an educated middle class. Those in the middle tax brackets could use their taxes to fund more research and development projects. They could also begin to focus their interests in learning how to revolutionize the industrial infrastructure to better utilize perma-culture techniques [ideal for carbon sequestration; and happens to be low cost and energy efficient], improve communications and tech or to revolutionize the industrial manufacturing using alternative forms of energy [not nuclear or biodiesel]. By making these innovations available, those within the top brackets could continue to influence consumer and international trading patterns of behavior and while everyone may not be ecstatic with the drastic changes, at least we'd be meeting the basic requirements of supporting the needs of those who could not otherwise afford it.

“For attractive lips, speak words of kindness.

For lovely eyes, seek out the good in people.

For a slim figure, share your food with the hungry.

For beautiful hair, let a child run his fingers through it once a day.

For poise, walk with the knowledge you'll never walk alone”

Lnapoli

Sam Levenson

No comments:

Post a Comment